That money of course will raise the US National Debt over the $10 trillion mark, but where does that money come from?

Normally Japan pays for a chunk of it, but this time China is footing the bill. Every American should go outside, find the first Chinese person they can and hug them. Or should they?

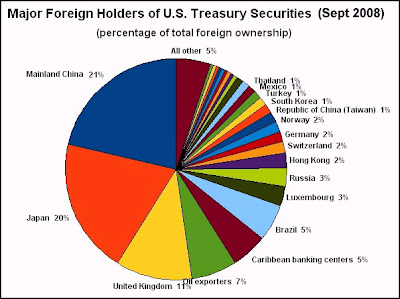

As of September China passed Japan to become the U.S. government's largest foreign creditor, the Treasury Department announced yesterday. Beijing's economic influence over the American economy has now reached titanic proportions.

As of September China passed Japan to become the U.S. government's largest foreign creditor, the Treasury Department announced yesterday. Beijing's economic influence over the American economy has now reached titanic proportions.China's new status -- it now owns over $2 out of every $10 in U.S. public debt -- means Washington will be increasingly forced to rely largely on Beijing as it seeks to raise money to cover the cost of the $700 billion bailout.

The growing dependence on Chinese cash is granting Beijing extraordinary sway over the U.S. economy. Analysts say a decision by China to move out of U.S. government bonds, for economic or political reasons, could lead a herd of other investors to follow suit. That would drive up the cost of U.S. borrowing, jeopardizing Washington's ability to fund, among other things, a stimulus package to jump-start the economy. If China were to stop buying or, worse, start selling U.S. debt, it would also quickly raise interest rates on a variety of loans in the United States, analysts say.

Worse, the more China invests in U.S. debt, the harder it becomes for U.S. companies to sell their products overseas. That's because China's purchase of U.S. bonds makes the dollar stronger, particularly against the Chinese yuan, which has been kept artificially weak to boost Chinese exports. The relatively weak yuan remains one of the biggest obstacles to U.S. companies tapping the market in China, particularly lucrative now as Beijing embarks on $586 billion in infrastructure and other stimulus spending to keep its economy humming amid the global crisis.

In the United States, Chinese influence is reflected in terms as basic as home mortgage rates. Since the U.S. government seized Fannie Mae and Freddie Mac in September, China, which maintains the world's largest cash reserves of roughly $1.9 trillion, has shed about $50 billion in the companies' debt and mortgage bonds. With China shying away from buying more, Fannie Mae and Freddie Mac have had to pay more interest to borrow and have gotten less for mortgage bonds, pushing up interest rates for people seeking home loans just as the U.S. government is trying to bring them down.

In good times, U.S. companies tapped China as a bargain-basement manufacturing hub, helping lift hundreds of millions of Chinese out of poverty. But China's torrid growth has also caused severe environmental damage from a rapid rise in pollution and industrial waste, even as it improved American lifestyles by putting cheaper televisions and microwave ovens within easier reach for consumers. In recent years, Chinese cash also became part of a massive surge in foreign capital to the United States that brought down interest rates and eased the credit terms that American financial institutions charged.

Now, in bad times, China is effectively co-financing the $1 trillion annual U.S. budget deficit and massive government bailout of the financial system. It is doing so in part with money earned from exports to the United States, which last year imported five times as much as it exported to China. Asian imports in general are hurting the US economy's ability to compete.

China's investment in U.S. Treasury bonds surged to $585 billion in September, pulling ahead of Japan's $573.2 billion worth. Overall, China's holdings may be $800 billion or more because they also purchase U.S. debt through third countries, and thus are not immediately recorded by the Treasury as being held by China, analysts say.

In contrast to Japan, one of the United States' closest allies, China is seen as less benevolent to U.S. interests.

Many economists are concerned about U.S. reliance on China for funding. By buying Treasury bonds, which are denominated in dollars, China is able to keep the dollar strong compared with the yuan. As a result, Chinese exports are cheaper relative to U.S. exports, and ends up hurting America's manufacturing industry.

That is a friction point at a time when the United States needs manufacturing companies to be competitive in the global marketplace to combat the economic downturn. U.S. labor unions are already pushing the incoming Obama administration to urge the Chinese to take steps to strengthen the yuan, which could involve a broad sell-off by China of U.S. Treasury bonds.

But as we've explained farther above that in turn would hurt America's mortgage and banking industries, so either way America is screwed.

The way we finance our national debt is unsustainable: It is madness! There is a better way. Check out www.sons4liberty.blogspot.com

ReplyDeleteVery good site, brilliant write up.

ReplyDeleteMaybe one or two thumbnails can be added.

I think it should be promoted to front page.

While at it, may I ask how you setup your review system?

Thank you

Itprovider